It's strange really.

I thought I'd try to make some realistic predictions of what patients should expect in the year ahead now that the "Patient Protection and Affordable Care Act" (PPACA) begins to sink it's tap root into the American medical system.

Triage

With the sudden expansion of the patient pool without a relative expansion of the physician pool, patients can expect a greater degree of triage to occur in medicine when they need to see a doctor. Triage will occur in many ways, but will fall along two lines: (1) treat the most urgent then (2) the most lucrative. Like it or not, these priorities will drive care for most medical facilities, especially our newly minted Accountable Care Organizations (aka, large hospital systems and care networks). Specialists will become purely proceduralists, internists and family practice doctors will see specialty follow-up and manage a team of nurse practitioners and "physician extenders," and these care extenders will become the front line care team for the more common ailments. In effect, follow-up specialty care will shift down the health care "food chain" to those less specialized in the name of improving "efficiencies" in health care. Some will argue this is cherry- picking lucrative patients and procedures, others will see this as a survival necessity for health care systems squeezed for revenue. Call it what you will, but realize it's another unintended consequence of the changes taking place in our health care market today.

Costs

There is no question that out-of-pocket costs (both direct and hidden) for health care will continue to rise for patients. Given the recent holiday season, most Americans are strapped for cash at the beginning of the year. But insurer's want their first installment for coverage as early as 10 January 2014. Hidden in their premium will be a 2% tax added to the every insurance plan's premiums, plus a $2 fee that goes to the Patient Centered Outcomes Research Institute (PCORI) created by our new health care law. As I've previously pointed out, the costly PCORI replicates functions already performed by the Agency for Health Care Quality and Research (AHRQ). The PCORI's budget is also scheduled to mushroom from $350 million to over $500 million annually in the years 2014-2019 with patients paying directly for this government agency thanks to this added fee. And what do they get in return from the PCORI? A wealth redistribution scheme to pay for even more "patient-centered" research redundancy.

Patient's take-home pay will also be reduced for middle-class individual tax filers earning more than $200,000 and families earning more than $250,000. This is because they will pay an added 0.9 percent Medicare surtax on top of the existing 1.45 percent Medicare payroll tax. They’ll also pay an extra 3.8 percent Medicare tax on unearned income, such as investment dividends, rental income and capital gains.

Finally, patients will quickly begin to understand what the terms "deducitible," "co-pay," and "co-insurance" mean when it hits their pocketbooks. My bet: they won't be happy about it.

Finally there's the issue of health insurance subsidies actually being tax credits. As reported in the Wall Street Journal:

The federal subsidies that will help many people pay for their coverage are actually tax credits tied to their income. They will go to people making as much as 400% of the federal poverty rate—in most states, $94,200 for a family of four in 2013. The more you make, the smaller your subsidy. The subsidy process "will all be part of the tax computation," says Judy Solomon, of the Center on Budget and Policy Priorities.The government giveth and the government taketh away. Hey, someone has to pay for all of this bureaucracy.

People can choose to receive these credits as monthly payments that flow to their insurers over the course of the year. But if they do this, and the subsidies turn out to be too large—if the consumer's income was higher than expected and she should have received a smaller subsidy than was dispersed—the recipient may need to repay at least part of the overshoot.

To avoid this situation, people should report major changes in income to their exchange website when they occur. Consumers who know in advance that their income may fluctuate can also take "less financial support," meaning a smaller subsidy upfront, or opt for a lump sum at year's end, says Cheryl Fish-Parcham, of the consumer group Families USA.

Confusion

The difficulties experienced with the government's HealthCare.gov website will have their trickle-down effects felt in 2014. Given the number of vendors involved in development of the site, and their unwillingness to claim responsibility for the site's shortcomings, patients who registered on the site are likely to have little recourse for their difficulties readily apparent. Social workers will be saddled with helping these patients, along with their other duties. As if they don't have enough to do already.

Doctors will be introduced (perhaps "force-fed" is a better verb) to the "new and improved" ICD-10 coding scheme in 2014. With bureaucracy run amok in medicine, this is another hassle foisted upon physicians and care-givers. Compliance with the scheme is now a pre-requisite for physicians to be paid properly. Expect more screen time, cursing, and less patient-care time from your doctor as a result.

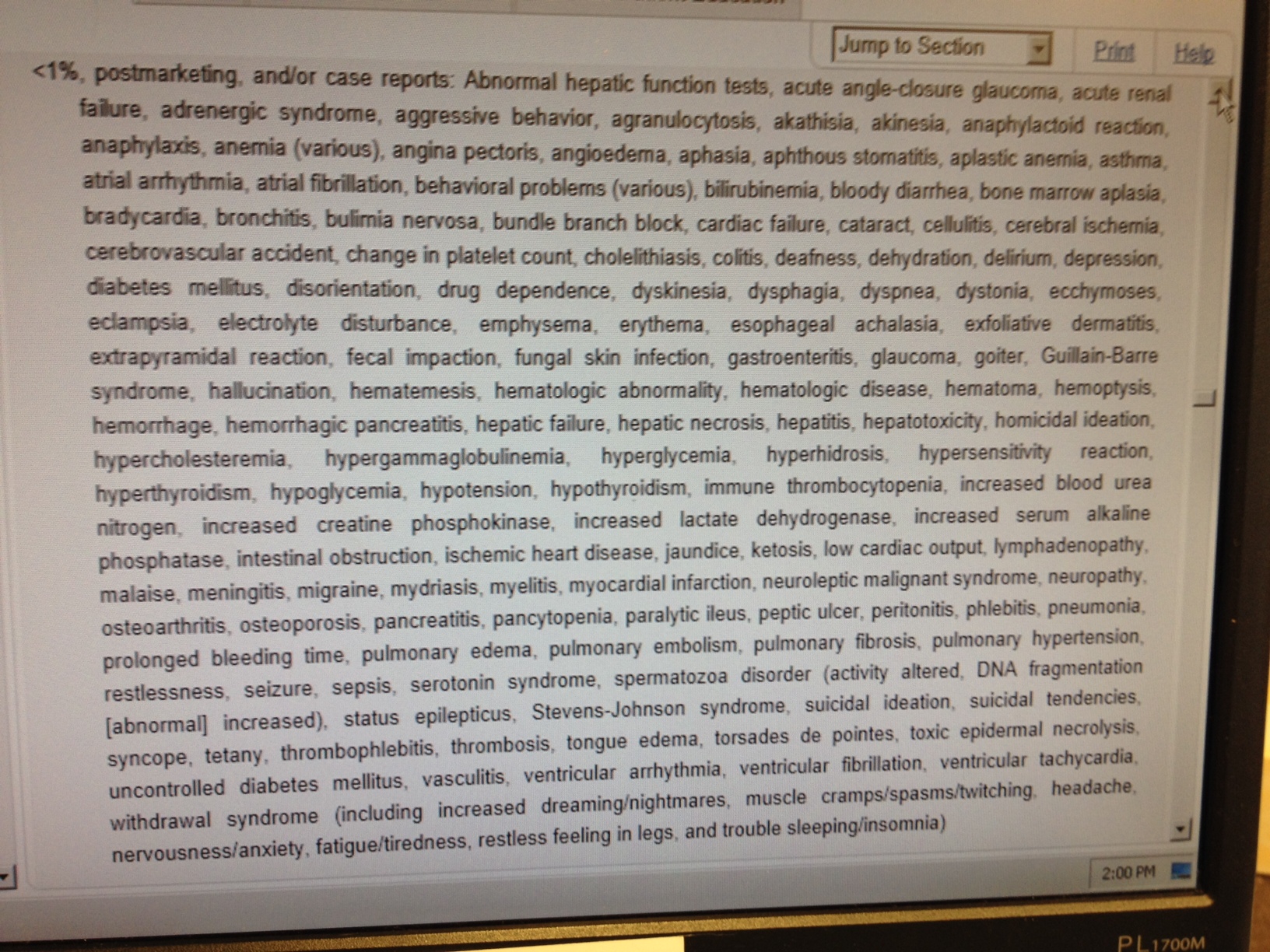

Insurers will be even more aggressive with denials based on insurance industry-developed "coverage decisions." Doctors and patients alike will continue to find this frustrating as insurers must assure their profit margins.

So as we begin the New Year, strap in, and get ready for Health Care 2014.

We're all going to be taken for quite a ride by the changes ahead. Rest assured, though, that there are still many doctors and nurses out there who will try to help ease their patients' burdens in such a stressful time for everyone.

-Wes