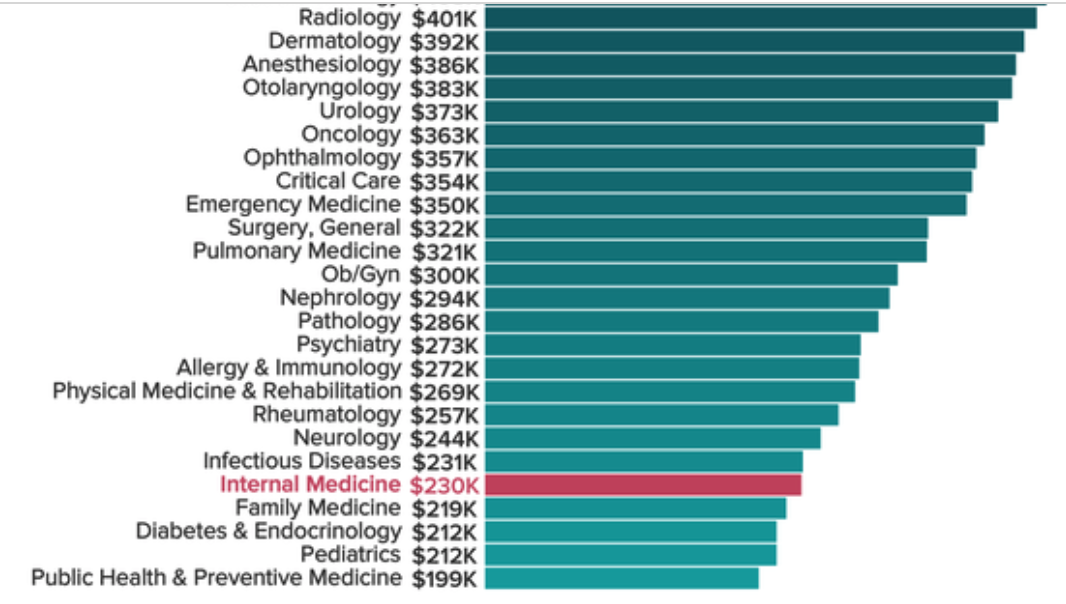

According to a Medscape survey of US internists in 2018, their average salary was $230,000.

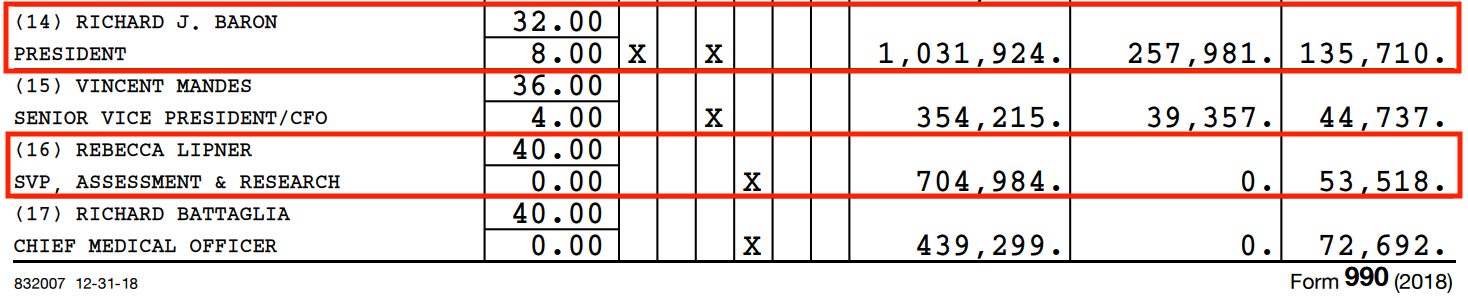

That same year, according to recently-released tax documents, Richard Baron, MD, President and CEO of the American Board of Internal Medicine (ABIM) and the ABIM Foundation, earned a cool $1,425,605 and non-physician Rebecca Lipner, the Senior Vice President, and Chief Financial Officer (who has never authored a study that wasn't supportive of the certification industry in her tenure with ABIM) earned $758,502:

(It is also notable that ABIM has a former PriceWaterhouseCooper executive serving as Chief Medical Officer that earns over half a million dollars annually as well).

Internists pay these salaries from their testing fees. Those same testing fees also pay "bonuses" that these executives unilaterally decide to bestow upon themselves, including "retention bonuses." But a "retention bonus" from an "early retirement severance package" makes absolutely no sense at all.

From ABIM's 2018 Form 990:

"IN 2016, ABIM MADE AVAILABLE TO CERTAIN ABIM EMPLOYEES AN EARLY RETIREMENT SEVERANCE PACKAGE WHICH INCLUDED A PROVISION FOR YEARS OF SERVICE. REBECCA LIPNER, ABIM SENIOR VICE PRESIDENT OF ASSESSMENT & RESEARCH, QUALIFIED FOR THIS EARLY RETIREMENT SEVERANCE PACKAGE. IN AN EFFORT TO ENCOURAGE HER TO STAY, ABIM OFFERED REBECCA LIPNER A RETENTION BONUS TO REMAIN EMPLOYED WITH ABIM AS SENIOR VICE PRESIDENT OF ASSESSMENT & RESEARCH THOUGH 6/30/2018. THE 2-YEAR AGREEMENT, SIGNED IN MARCH 2016, PROVIDED FOR THE PAYMENT OF A RETENTION BONUS WITHIN 30 DAYS AFTER 6/30/18 IF CERTAIN TERMS AND CONDITIONS, AS PROVIDED IN THE AGREEMENT, HAD BEEN FULFILLED.AS OF 6/30/18, THE TERMS AND CONDITIONS PROVIDED FOR IN THE AGREEMENT HAVE BEEN FULFILLED. IN COMPLIANCE WITH TERMS OF THE SIGNED AGREEMENT, IN JULY 2018, ABIM RESEARCH, A ONE-TIME RETENTION BONUS IN THE AMOUNT OF $300,000. AS PER INSTRUCTIONS FOR SCHEDULE J, $300,000 WAS INCLUDED ON SCHEDULE J PAID REBECCA LIPNER, ABIM SENIOR VICE PRESIDENT OF ASSESSMENT..."

Salaries to some executives of the ABIM have almost doubled since 2010. These exorbitant salaries and questionable "bonuses" are little more than taxation to physicians without appropriate representation.

It is time to end this nonsense.

-Wes

6 comments:

I spoke with an officer at the IRS about the ABIM. After describing the corporation and the magnitude of the executive payouts and perks the officer's response was, "it doesn't sound like a not-for-profit to me."

The ABIM lied long and loud about the value of MOC putting huge profits in

their pockets.

ABIM's obfuscatory tax forms often mistate or omit, but indisputably reflect the unjust enrichment of executives.

Tax forms tell a story

The birth of the ABIM Foundation

As ABIM's examination fees increased over the years profits increased. The ABIM, as a result, became concerned with their 501(c)(3) non-profit status. So in 1989, they created a convenient vehicle for obscuring their growing wealth and inurement. This financial vehicle was the ABIM Foundation, into which they poured millions and millions of surfeit dollars over a period of about eighteen years.

Swimming in cash

They were swimming in cash and put it in the Foundation rather than rebating the excess certification/MOC payments back to physicians , or lowering fees. The ABIM was for years a semi-secret bank account that was administered out of the same ABIM offices.

Certification and MOC

Until 2005 all their certification and MOC revenues were lumped together under one heading "examination fees". The MOC revenues were hidden in a single line, while for their own records they were conducting double ledger accounting. MOC in one column and certification in the other.

MOC comes out

In 2005 ABIM obviously became concerned that their growing certification and MOC booty might stand out like a sore thumb to the IRS. So, during that same year they decided that their combined certification and MOC fees should be bifurcated. MOC, although always a separate product on their own books, was officially born that year on their IRS tax forms when they bifurcated the previous single entry "examination fees" - transforming it to conform to reality on their tax returns. They did this out of fear that their "examination fees" were growing to fast and that the for the IRS might in an audit call them out on their separate MOC product. The truth is a double edged sword.

MOC as a for-profit "spin-off"

They were also concerned that the IRS might examine their new MOC product and examine their enhanced business model. If scrutinized the IRS review might conclude that the sale of the MOC product could be seen as a separate for-profit business. (July 2005-2006 tax forms).

And indeed MOC is a for-profit business that should have been spun off in the same way the ABMS spun-off their "data solutions" business, called "ABMS Solutions".

A grandfathered non-profit 503(c)(3) public charity?

The ABIM had another deep secret that they did not want the public or IRS to know. The new revenue streams from MOC might also draw the attention of the IRS, the core executives and board opined. That was part of the reason for the creation and existence of the ABIM Foundation.

The Foundation helped ABIM hide the steadily increasing profits. It was also an investment vehicle and war chest.

They feared IRS scrutiny. And for good reason; they were a grandfathered non-profit organization from 1936. This is what they claim. In their disclosure statement over the years they failed to mention this or explain. Now in a bifurcated false reality they claim that they have form 1023 available on their website or upon request. But in an obscure line in the back of their tax forms hidden away they contradict what they already alleged by saying that they do not have a form 1023 for view. Why? because form 1023 was not required in 1936. How's that for not keeping up. They have never been reviewed by the IRS!

No form 1023 an not letter of determination that all are required to display

This means that because the federal and state tax laws were so lax during the great depression they were never really scrutinized for the exemption boon they were granted.

In essence ABIM's tax status is analogous to a physicians who never went to medical school, but was gifted with an honorary medical degree. The ABIM never had to get a "certification" or rigorous determination of non-profit status from the IRS.

And they are walking on egg shells every day with the IRS as a result

More hypocrisy, in fact, as they want physicians to do MOC or longitudinal assessment every year, while they have never gone through the required rigorous initial test that the IRS administers to all non-profits today. A rigorous test to make sure they are a non-profit and not a for-profit business.

From ABIM's 2018 tax filings: "Section C Disclosures"

"18. Section 6104 requires an organization to make its Forms 1023 (1024 or 1024-A if applicable), 990, and 990-T (Section 501(c)(3)s only) available

for public inspection. Indicate how you made these available. Check all that apply."

"X website X upon request."

They allege in "Schedule O" of their IRS tax filings that they did not need one when they incorporated in 1936. This singular line was buried in the back of the forms as a footnote.

"FORM 990, PART VI, SECTION C, LINE 18:

FORM 1023 WAS NOT REQUIRED AT THE TIME OF INCORPORATION (1936)."

Tax-exempt executive income - the high stakes ABIM/ABMS MOC® tax advantaged plan

I looked over the tax returns for ABIM from 2002 until 2018. Focusing on Pearson NCS/Pearson Vue as the highest paid contractor, the last reported figure for their services was in the fiscal year ending June 30, 2008. ABIM has altered the way they report this expense in subsequent years. They list a lump sum under certification and MOC exam expenses. They paid them a whopping $4,698,525. This was roughly 15.56% of the combined certification and MOC revenue for that year, which was 30,193,842.

If we take this formula of 15.56% of the combined certification and MOC revenue, we get for 2018 get a staggering number. Here's a breakdown. Certification revenue was $29,643,084 and MOC revenue was $23,816,415. Total revenue was $53,489,500. X 15.56% = $8,322,966. If this formula is correct then Pearson, LLC has doubled their revenues from the ABIM in ten years.

Extrapolating this formula out 9 years, we realize ABIM and Pearson are extremely lucrative business partners with serious money passing between them. Over the next nine years Pearson will enjoy $74,906,695 from ABIM. Looking out further, if that figure doubles again over the next 10 years the revenue is 150 million paid out to the British media giant Pearson.

With longitudinal assessment just around the corner, the next version of MOC ABIM is pushing, utilizing annual online proctored tests with several session that figure could go up or down depending on the reliability of Pearson's online platform and any renegotiation.

To answer the initial question, the answer is by any objective reasoning, yes. The ABIM has transformed. They morphed into a for-profit corporation during the 1960's when "ABIM Chairman" ABMS "President" Thomas Brem, "MD" lobbied on behalf of Big Money Big Tobacco in Washington DC.

Lying to a congressional committee/giving false and misleading "expert testimony" under oath that there was insufficient evidence linking cigarettes to cancer. The ABIM/ABMS' reputation was damaged forever at that point. Sold to the highest bidder.

Brem had the dual result/effect of undermining the common public good and betraying the profession of medicine.

MOC is a virulent profit-seeking growth strangling the profession of medicine and public health doubling in virulence every ten years. MOC is a sick ABMS addiction. It betrays all in the same way that cigarette addiction undermined/undermines the health of a nation.

MOC is moreover a public health crisis as much as any loaded gun. This is not hyperbole, but factual. Let's reduce stress, burnout, and suicide in medicine by ending mandated MOC. Let's increase the quality of care and patient access by doing the right thing. End mandated MOC now.

An injunction or settlement/verdict from a civil action is not enough. We need to also work together to introduce and pass federal legislation that protects the profession of medicine and patient population (public) from the harms of the MOC mandate. The corruption in this country and at the ABIM/ABMS has gotten away from all of us. The MOC mandate needs to be excised from the certification process forever.

Post a Comment