|

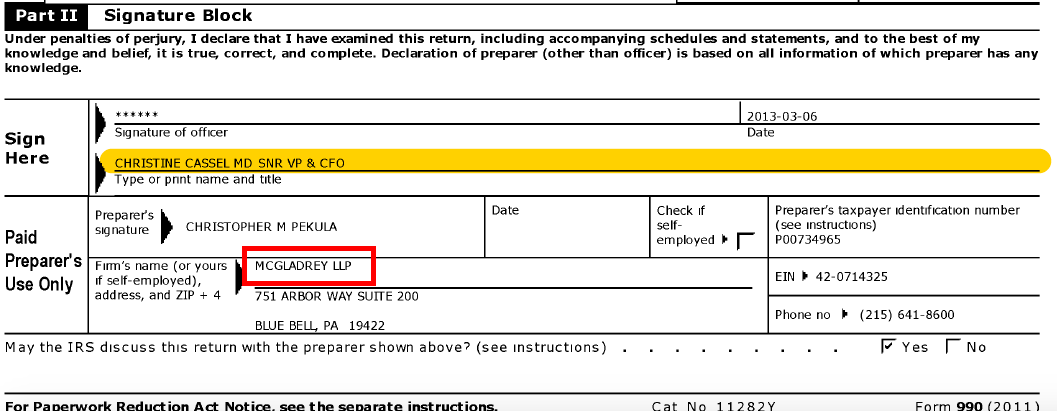

| ABIM 2011 Form 990, Page 1 - Signature Line |

McGladrey LLC has a long history of accounting deficiencies, but this one might take the cake. ABIM's paid McGladrey LLC a whopping $361,753 for "accounting/consulting" services in fiscal year 2011. This amount is over three times the usual accounting fees ABIM historically paid.

Why?

Was there such significant cover-up that ABIM's true Chief Financial Officer at the time, Vincent Mandes, wouldn't sign the tax form?

-Wes

PS: Recall that the AMA House of Delegates requested a formal independent audit of the ABIM. The AMA asked Richard Baron, the President of CEO to respond to that request. An independent audit was never granted. Instead, Richard Baron, MD issued this statement.

PS: Recall that the AMA House of Delegates requested a formal independent audit of the ABIM. The AMA asked Richard Baron, the President of CEO to respond to that request. An independent audit was never granted. Instead, Richard Baron, MD issued this statement.

8 comments:

Bravo, Dr. Baron. Despite your pledge to "respond fully, accurately and transparently", your feckless response to the AMA HOD call for independent audit of ABIM financials demonstrates once again that you're not very good at Deliberately Obtuse mode as your tone deaf response asserts that that ABIM Form 990s and audited financials already represent "full transparency". Your colleagues/predecessors, Dr. Cassel and Dr. Wachter were much more accomplished and somewhat entertaining with their implementation of the ABIM tap dancing/smoke show, honed to a high level after years of refinement. In any case, it won't matter as it must be clear to you that ABIM's days are numbered. It may provide some solace that your name is destined to be immortalized in business textbooks alongside icons of American business fraud like Charles Ponzi, Charles Keating, Kenneth Lay, Michael Milken and Bernie Madoff.

Wes, Richard Baron's letter of response to the AMA that you posted was laughable. Tricky Dick couldn't make it past the first paragraph without presenting one flagrant misstatement after another:

"As an organization entrusted by doctors and patients to set standards on behalf of the medical community"

-Based on my admittedly informal samplings, patients (and medical students for that matter) are largely oblivious to the board certification process. Medical students, in fact, typically give me a dumbfounded look when I mention the implications and potential consequences of mandated (not "voluntary") recertification . And entrusted by doctors? The majority of physicians recognize and resent the sham process in its entirety, save perhaps initial certification.

" We know that physicians take pride in their certification and link their credibility and trustworthiness to their ABIM credential."

No comment needed here. This statement begs for the Bull***t Stamp

"The credential we issue—on which physicians and others rely—is no better than the standards and integrity behind it."

True, ironically true.

"As we receive 100% of our revenue from diplomate fees—and none from the pharmaceutical industry or the government—we are committed to financial transparency. "

'Diplomate fee' should be a new term coined in the Urban Dictionary for 'Extortion money'

"In the three and a half years I have been the CEO at ABIM, I have made every effort to set higher standards to be more open and follow best practices in financial transparency."

Herr Doktor has been in the darkness of the besieged ABIM Chancellory bunker a little too long. Blind to the truth.

This blatant error on page one begs the question, what else did they get wrong?

Where did the money go?

Paid to Independent Contractors

2011 Ind Contract RSM $361,753 Consult/Acct

2011 Ind Contract Ballard Spahr $2,287,145 Legal Services

Actual Legal and Accounting Expenses

2011 Legal $1,886,145 ?

2011 Acct $107,240 ?

Paid to Independent Contractors

2012 Ind Contract RSM $348,139 Consult/Acct

2012 Ind Contract Ballard Spahr $2,249,349 Legal Services

Actual Legal and Accounting Expenses

2012 Legal $1,026,406 ?

2012 Acct $88,625 ?

A Federal judge says Ballard Spahr attorneys in ABIM v Sarah Von Muller overbilled ABIM in 2012 for excessive and duplicative charges. Ballard Spahr billed for undocumented and poorly documented work, while using the trial for training inexperienced associates and an army of paralegals/researchers.

Everyone involved at ABIM from Cassel to Langdon to Mannes to Weinstein were making a market and name for themselves out of the needless and reckless persecution of young physicians who attended an accredited Board review course.

Reduntant court appearances at trial by a partner and associate asigned different tasks were also brought into focus. ABIM was billed over 1 million dollars through June 2012 in the case of ABIM versus Von Muller versus ABIM, et al.

The legal fees charged to ABIM from 2009 to present skyrocketed up 8 to 9 times compared to some of its prior years.

Knowing very well that ABIM was unethically and perhaps illegally overcharged for legal services, we ask did the ABIM seek a reimbursement at a later time?

As we suspect this was the case, from looking at pertinent IRS And federal court documents, Huge unexplained gaps in accounting appear under scrutiny and a great deal of time.

ABIM executives have to explain the accounting ommissions and misrepresentation.

There appears to be money that was not documented properly, and with no accompanying statement. Just as in lying about the lobbying and not documenting it the connections of large sums of poorly documented legal charges and consulting fees jump out at you. It puts the secret money transfers to the Foundation in a bright light.

The murky financial statements begin to tell a story in what they say, but even more by what is left out.

Ballard Spahr's overcharges

What did the ABIM do with it's "recovered money" and did they file amended returns as would be necessary. If the Ballard overbilling was sent via US local mail as the federal judge inferred, it is fraud. Why did Von Miller's attorney or ABIM not file a complaint/seek to have BS indicted on charges of mail fraud. How could they trust them after that? The only explanation is that the mutually wished to ruin a mother of ten. It is all there in court documents and the judge prevented their malice.

Ballard Spahr and ABIM may have colluded to hide money to use for their shady slush funds in order to pay for undisclosed felons unscrupulous attorneys that appear as lead attorneys in filings, but suddenly disappear from the documents provided to the court. Why were Marc J Weinstein's invoices and hours missing as was his name? It all begins to make sense.

What about that huge bonus of nearly 300K for Lynn Langdon and deferred (unfunded) PAYMENTS to Christine Cassel Cassel, Eric Holmboe, and John K Davis III when they left ABIM in 2013. Where did ABIM get all that free cash flow?

A slush fund for lobbying has already been verified here as open secrets published documents to clealy indicate this. To lobby and not report it is fraud. One needs additional sources of undocumented funding for that.

As we can read in readily available court documents the facts are undisputed that Ballard Spahr was caught in deceptive billing practices. ABIM from looking at tax filings has some very big chasms for money to get lost in the divide between what they pay their attorneys and accountants and where the money actually goes.

In looking over the tax forms available all the way back to 1997 (Foundation) it is clear to me that there is need for an independent audit by objective justice department officials and the IRS.

Judge Joyner carefully noted that much of the work that Ballard Spahr did for ABIM was inadequate ly documented or not documented at all. It is fair to say that if a physician failed to document his or her work in such a reckless manner they would be sanctioned or losing their license to practice and facing charges of defrauding insurers and their patients and/or the federal government.

One wonders, at this point, if there is anything that is not fraudulent at the ABIM, especially the accounting. MOC is a no-brainer at ths point. Even the New York Times author agrees it is a Ponzi scheme. But that MOC is just the tip of the iceberg regarding the coverup and free money they give to each other and use to protect their ABIM/ABMS corporate financial empire.

More on ABIM v. Von Muller

More accounting irregularities (in light of the missing Weinstein billing documentation and his involvement in ABIM v Sarah Von Muller.

Weinstein (and Ben Mannes) along with Ballard Spahr and other executives and employees worked on the von Muller case from early 2010 to 2014, and perhaps later. Weinstein's part was certainly pivotal from early 2010 to early 2012. (And later after he withdrew from the case on Jan 10, 2012 in terms of coaching novice attorneys who were on a need to know basis parroting the rehearsed story lines and legal strategies.

Here we have a clear case of cover-up and fraud as No BILLABLE HOURS or CHARGES were presented to the FEDERAL COURT in calculating his contribution. Incidentally, one other Ballard Spahr associate withdrew from the case, but he was an incidental attorney used for research and training. This was Steven D. Kim. His billable hours are listed as they should be. But not Weinstein's, who the initiator of the initial complaint, amended complaint, researcher, coach and chief Ballard Spahr investigator from day one. Why?

The list of late appearances to the case contain numerous Ballard attorneys all with substantial charges made to ABIM. I'd like to know how the federal judge, who received senior status in 2013 explains all this mess and the improperly docuemented (perhaps fraudulent) entries on the parts of Ballard Spahr/ABIM. Not documenting Weinstein means the whole record is fraudulent due to the omission of the key actor. One suspects that the hours were just transferred to others' billable hours, or they just paid Weinstein by use of some unknown ledger system, that boggles the imagination.

ABIM could have corrected the accounting with a memo to the court. But they sent nothing or it would have been corrected. This is one of the biggest coverups, and so obvious, that it is an embarrassment and a slap in the face of our judicial system.

If they can't count and report to the court honestly, and the judge can't remember who was in this and every other ABIM versus physician/boa

rd review case, how can we expect the evidence in the court to be fair and sound. We can't. We can say this, without hesitation that what happened to Sarah Von Muller and others was a travesty. It is shameful and criminal what was done and still continues to be done and the ABIM's "politically dumb" tax numbers, money transfers, real estate endowment, Cayman hedge funds, lavish trips and retreats, outrageous compensation packages while lobbying for political agendas and pressing flesh in the corporate interest, and all the rest of the graft tells a story. It is not very pretty, this ABIM story in its entirety. Von Muller and al the others should be given an apology paid for by Ballard Spahr and ABIM and placed in the Wall Street Journal and New York Times at a minimum.

Where is Weinstein? Kim, a Ballard attorney who played a minor role is listed even though he came in for his training and then withdrew. They billing presented to a federal court is presented even to the slightest contribution of an hour plus a fraction. Where is Marc Jacob Weinstein?

https://law.justia.com/cases/federal/district-courts/pennsylvania/paedce/2:2010cv02680/363083/190/

More numbers from ABIM's tax forms that don't add up or are completely suspicious

July 1, 2009 to June 30, 2010.

Independent contactors

Ballard Spahr (Philadelphia, PA) legal services $1,452,439

Cecity (Homestead, PA) software services, $600,000

Actual "legal expenses"

Ballard Spahr (and unknown entities) $1,689,386 ($236,947 is the cost above Ballard Spahr charges. Who got the money? Is there documentation on the tax forms to account for it? Why not?

Actual "software expenses"

Cecity $600,000 (I really have a problem with the round numbers provided to Cecity each year. No other independent contractor, especially among the software industry, bill with such round numbers. Only the "grants" to the "Foundation" come in round numbers.)

Christine Cassel (CEO of ABIM 2003-2013) was a board member at Premier, Inc. (and predecessor companies) from 2008 to 2014. Premier, Inc. purchased Cecity in 2015.

Under Information technology expenses, in the 2009 tax forms, the ABIM leaves this item blank on their returns. It appears that Cecity may have been providing cart blanch free services as needed to the ABIM in exchange for "expert advice" from a Premier, Inc. insider, perhaps even Cassel herself, but this is doubtful. The company was being tailored/groomed to be the perfect fit as a takeover target. Service such as serial advice (as well as lobbying expenses) come in round-number figures paid by company checks. And as we know, all too often it is even undocumented and paid with envelopes full of hundred dollar bills. Or a bartered exchange of services.

Accounting fees were claimed to be 91,706 in 2009 by ABIM/McGladrey. Not even McGladrey is allowed to round their charges off to an even 92K or even 91,700. It must be precise, and rounded to the dollar. Earlier tax forms from Marc Feldman's time actually listed financial services expenses. Typically 7 to 12K. The millions of dollars paid to Pearson appeared on the forms under Feldman, never in round numbers, but not anymore. Why? The charges were certainly for an independent contractor. Or does the ABIM now consider themselves a subsidiary of Pearson or vice versa.

Feldman also worked for GlaxoSmithKline as a marketing director for nine years.

And what about those retreats to the Four Seasons and the Ritz at Laguna Niguel. Do they even list those perks anymore? Those are not round numbers either.

The current ABIM CFO appears to be clean coming from the "Doherty restauraunt empire". 12th largest chain of companies (including Panera) in the country. Who subsidized all those ventures?

Mr Mandes' the ABIM CFO's last employment was with the Rose Group before Doherty Enterprises acquired 38 restaurants/properties from the Rose group, which has a portfolio of restaurants and real estate holdings.

Post a Comment